Secure Your Family’s Future with Flexible Coverage - Zurich ValueLife

Safeguarding Life’s Precious Moments

At Zurich, we understand the importance of protection so that your loved ones can continue to enjoy what life has to offer even when you are no longer around. This is why we introduce Zurich ValueLife – a unique plan that offers flexible and comprehensive protection with a wide selection of riders such as critical illness, medical, waiver of premium and more.

Note: This is an insurance product that is tied to the performance of its underlying assets and is NOT a pure investment product like unit trusts.

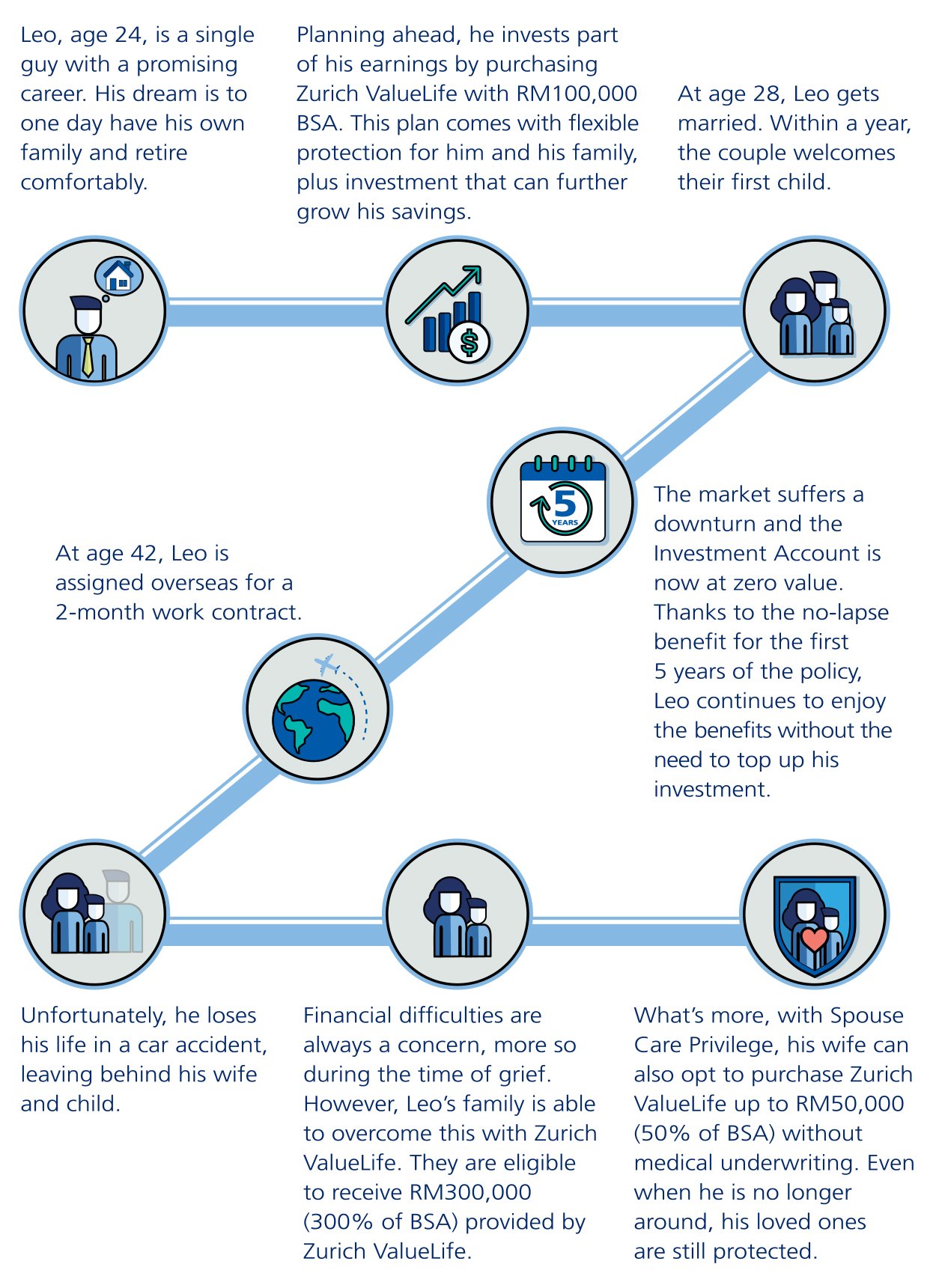

High Protection up to 300% of Basic Sum Assured (BSA)

Zurich ValueLife offers up to 300% of your insurance coverage amount in the event of unfortunate incidents as listed below:

| Insurance Coverage Amount | 100% of BSA + IAV4 | Death or Total and Permanent Disability1 (TPD) |

| 200% of BSA + IAV4 | Public Conveyance Accidental Death2 | |

| 300% of BSA + IAV4 | Overseas Accidental Death3 |

1 The TPD coverage is only applicable up to age 70 of the Life Assured.

2In the event of death of the Life Assured within 365 days from the date of accident from commuting in Public Conveyance.

3 In the event of death of the Life Assured within 365 days from the date of accident while travelling overseas for not more than 90 consecutive days per trip.

4 The Policy Owner will also receive the amount in the Investment Account Value (IAV), if any.

*Note: Only the highest payout as listed in the table above will be paid out.

Spouse Care Privilege

During times of uncertainty, the spouse can continue to be protected. The spouse can purchase a life policy up to 50% of BSA without medical underwriting when the Life Assured passes on. Life Assured may register his/her spouse at any point in time during the policy term and the spouse must exercise this privilege not later than 6 months after the death of Life Assured.

No-Lapse Benefit for the first 5 policy years

This valuable feature ensures continuity of coverage even if your Investment Account Value (IAV) is zero or in the negative due to market fluctuations. The premiums (including revision of premium payment as requested by us) must be paid consistently before the due date and no withdrawal is made within the first 5 policy years.

Note:

Any variation on premium and benefits are subject to the conditions determined by us in order to enjoy this No-Lapse Benefit. Terms and conditions apply.

Flexibility to adjust protection, coverage and investment levels

Zurich ValueLife gives you the control and flexibility to customize the levels of protection, coverage amount and premium at any time to meet your evolving needs. You may also choose from coverage of 20 years or continuous coverage up to age 70, 80 or 100 years. Furthermore, your policy term will be auto-extended* up to age 100 without the need to go through underwriting.

*You may be required to pay an additional premium. We will notify you of the extension and any additional premium required by giving you at least three (3) months' notice prior to the extension.

Maturity Benefit

For coverage of 20 years or continuous coverage to age 70 and 80, you will receive the remaining Investment Account Value (IAV) in your account upon maturity. Upon maturity at age 100¹, you will receive a lump sum of 100% of the Basic Sum Assured (BSA) and the remaining Investment Account Value (IAV) in your account.

1 You may need to top-up your premium along the way for continuous coverage.

Zurich ValueLife is open to anyone between 14 days old and 70 years old (attained age). However, the policyholder must be at least 16 years old.

The benefits payable are protected by PIDM up to limits and the protection on benefits from the unit portion is subject to limitations. Please refer to PIDM TIPS brochure or contact Zurich Life Insurance Malaysia Berhad or PIDM.