AEON Bank and Zurich Malaysia’s Takaful Arms Unlock Affordable Takaful Protection From Only RM5 Monthly

Democratising Takaful for Malaysians with Easier Access via the AEON Bank App ![]()

KUALA LUMPUR, 25 November 2025 – In the era of digital banking; accessibility, convenient user journey, security and rewarding benefits are the deciding factors for customers. Aligned with that understanding, AEON Bank (M) Berhad, the first digital Islamic bank in Malaysia continue to strengthen its strategic partnership with Zurich Malaysia, through its family Takaful arm, Zurich Takaful Malaysia Berhad (ZTMB) and general Takaful arm, Zurich General Takaful Malaysia Berhad (ZGTMB) by integrating affordable Takaful protection with digital banking convenience.

This is a continuation of last year’s tripartite partnership between Zurich Malaysia and AEON Bank that was initiated last year in May 2024. It reflects a shared vision to meet the modern consumer's demand for security and convenience, with the goal to deliver unprecedented affordability and digital accessibility by integrating essential Shariah-compliant Takaful protection plans directly into the AEON Bank app.

Takaful Protection at Your Fingertips : Minutes to Peace of Mind

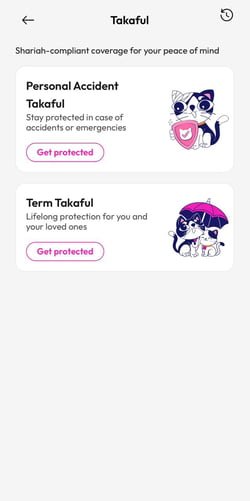

AEON Bank and Zurich Takaful focused on value and benefits to co-develop two key offerings - ‘Personal Accident Takaful’ and ‘Term Takaful’; now conveniently available via the AEON Bank app, starting from 29 October 2025. Designed to be inclusive and affordable for today’s modern consumers seeking Shariah compliant coverage to fit the needs of their families and individual lifestyles, from as low as RM5 per month for Personal Accident Takaful and RM18 per month for Term Takaful.

Speaking at the ‘A New Era of Protection’ media engagement today, co-hosted by AEON Bank and Zurich Takaful on 25 November 2025, AEON Bank’s CEO, YM Raja Datin Paduka Teh Maimunah Raja Abdul Aziz highlighted this value proposition, “Technology and digitalisation continue to change the way we live, connect and protect our loved ones. Our partnership with Zurich Takaful is a meaningful extension of AEON Bank’s commitment to provide affordable, Shariah-compliant Takaful protection seamlessly into the digital ecosystem. Our customers are already using the AEON Bank app on a daily basis for their digital payments, while managing their budget and finances, so being able to select affordable Takaful plans and protect themselves and their families through the same familiar platform that they trusted is the natural next step for them. Our goal is to provide the right products to enable our customers to live fully, care for their families, as well as protect themselves, go on adventures and enjoy every moment with greater peace of mind, as protection is within the app’s reach.”

Members of the media and content creators at ‘The New Era of Protection’ on 25 November 2025.

In his speech during the media engagement, Country CEO of Zurich Malaysia , Junior Cho, commented, “This partnership harmonizes AEON Bank’s digital innovation, Zurich’s global protection expertise and Zurich Edge’s proposition to create an accessible way for Malaysians to experience Takaful in a new way. With over 150 years of global experience, Zurich has earned the trust of millions worldwide by providing reliable and forward-looking protection solutions. Our goal is to make ethical, inclusive protection accessible to all by keeping it simple to start, easy to understand, and resonating with modern lifestyles. This marks the continued delivery of micro-Takaful solutions that meet the needs of individuals and families across the country, helping to create a brighter future for all.”

Both the Personal Accident Takaful and Term Takaful plans are 100% Shariah compliant and accessible 24/7 via AEON Bank app, enabling customers to manage their coverage anytime, anywhere via their smartphones. This approach shatters the barriers to entry by offering the best value and a fully digital user journey. Available for Malaysians aged 18 to 59 years old, the entire process, from selection to enrolment is designed to be quick and easy, taking only minutes to complete entirely within the AEON Bank app.

● Personal Accident Takaful Plan: Available from as low as RM5 per month, its exceptional value makes this essential protection accessible to everyone. It offers coverage in the event of total permanent disablement or accidental death, with a sum covered selection of either up to RM50,000 or RM80,000.

● Term Takaful plan: Available from as low as RM18 per month, it offers broader protection, covering death or total and permanent disability due to all causes (natural and accidental causes), including funeral expenses and daily hospitalisation benefits with the sum covered selection up to either RM50,000 or RM80,000.

Simple and Accessible Way to Activate Your Takaful Protection via AEON Bank App

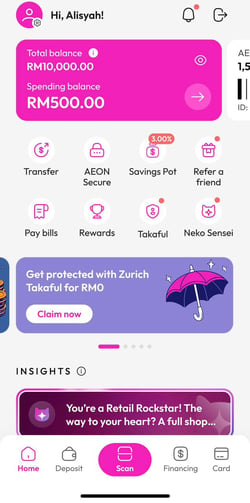

● Step 1: Download the AEON Bank app from the App Store or Google Play and complete your registration.

● Step 2: On the Home screen of the app, click on the “Takaful” icon.

● Step 3: Click on the ’Personal Accident Takaful’ or ’Term Takaful’ to view the coverage details, benefits and contribution options.

● Step 4: Click “Confirm” and proceed with the subscription payment to activate your selected Takaful protection.

● Step 5: Once subscribed, you can view your Takaful certificate, monitor your coverage and manage your payments.

Best of all, your Takaful plan is easily accessible via the AEON Bank app, so protection is always within your reach. Moving forward, AEON Bank and Zurich Malaysia will continue to develop inclusive micro-Takaful and broader Takaful protections, with practical offerings to reflect the fast-faced lifestyle of Malaysians in the digital era.

Click on this [link] to watch the video, visit AEON Bank’s website https://aeonbank.com.my/, and download the app by scanning the QR code below.

About AEON Bank (M) Berhad

AEON Bank (M) Berhad is the first digital Islamic bank in Malaysia, licensed and regulated by Bank Negara Malaysia and the Ministry of Finance. Officially launched on 26 May 2024, we currently offer a suite of Shariah-compliant products and services under the Personal Banking and Business Banking (AEON Bank Biz).

Our Personal Banking offerings are 100% accessible via the AEON Bank app, namely the deposit Savings Account-i, AEON Bank x Visa Debit Card-i, Personal Financing-i, Term Deposit-i, Savings Pots, DuitNow QR, utility bill payments, personal financial management and budgeting tools with Neko Sensei, and a range of digital payment services with strategic partners and merchants, as well as Neko Missions, Malaysia’s first gamified digital banking interactive rewards programme.

On 8 August 2025, AEON Bank (M) Berhad officially launched AEON Bank Biz, anchored by the Current Business Account-i and integrated cash management capabilities, with the initial onboarding of vendors from AEON Credit Service (M) Berhad and suppliers within the broader AEON ecosystem. The targeted approach is designed to create an integrated value chain linking AEON’s retail and financial services networks, supporting strategic growth and greater inclusivity. AEON Bank Biz offers streamlined processes for account onboarding, credit assessments and financial services, utilising AI-driven fintech solutions to enable simplified procedures, faster approvals, and an enhanced digital banking experience for business owners and entrepreneurs. AEON Bank Biz’s products and services will soon be extended to more local businesses and entrepreneurs across Malaysia.

Being part of the AEON Group conglomerate, AEON Bank (M) Berhad is equally held by AEON Financial Service Co. Ltd. (AFS Japan) and AEON Credit Service (M) Berhad (ACSM). AFS Japan is responsible for the AEON Group’s financial services businesses, with strong roots in the retail sector which operates in Japan and 10 countries across Asia and it is. AEON Group is Japan’s largest retail group and it is a pure holding company that comprises eight core businesses.

AEON Group Malaysia consists of several entities, namely, AEON Co. (M) Bhd, AEON Credit Service (M) Berhad, AEON Bank (M) Berhad, AEON BiG (M) Sdn Bhd, AEON Fantasy (M) Sdn Bhd, AEON Delight (M) Sdn Bhd, AEON Global Supply Chain Sdn Bhd and Malaysian AEON Foundation (MAF). AEON Group has been a recognizable household brand with more than 200 years of history and evolution in Japan since the Edo era, along with 4 decades of growth in Malaysia, providing consumers with daily financial solutions and diversified retail convenience.

Our cloud native agility and AI optimisation, combined with the strength of our Shariah DNA, Malaysian roots and Japanese heritage are our distinguishing factors, while the integration with the AEON ecosystem gives us a competitive advantage of being the only bank in Malaysia with its own nationwide retail network. On top of that, AEON Points loyalty programme offers customers value-added benefits and meaningful rewards, as the AEON Points can be redeemed into cash value, deposited directly into customers’ AEON Bank Savings Account-i.

AEON Bank (M) Berhad is committed to provide accessible financial solutions for Malaysians and we aim to empower the community in pursuing their financial aspirations and achieve economic independence, hence fostering a more inclusive financial future for all. We will continue to contribute towards the Islamic banking development in the region and the nation’s digital economy.

About Zurich Malaysia

Zurich Malaysia is a collective reference term for the Zurich Insurance Group (Zurich) business subsidiaries operating in Malaysia: Zurich General Insurance Malaysia Berhad, Zurich Life Insurance Malaysia Berhad, Zurich General Takaful Malaysia Berhad and Zurich Takaful Malaysia Berhad. Zurich Malaysia offers a broad range of comprehensive insurance and takaful solutions; helping individuals as well as business owners understand and protect themselves, their businesses and their assets from risk. Zurich Malaysia has an integrated branch network in major cities nationwide as well as dedicated agency and distribution channels nationwide to serve the needs of its customers. For further information on Zurich Malaysia, visit www.zurich.com.my.

About Zurich Edge

Zurich Edge is a flagship digital partnerships proposition that delivers tailored and innovative solutions for customers within a partner’s ecosystem. With its open architecture full-stack platform, Zurich Edge enables seamless journeys, personalized experiences, and optimization capabilities to drive deeper engagement with digital consumers and unlock unparalleled value for partners’ businesses. Leveraging Zurich’s strong insurance expertise, Zurich Edge comes with a dedicated digital squad in each Asia Pacific market to co-create and launch insurance opportunities that deliver competitive advantages.