High Protection Family Takaful Plan with Flexible Contributions - Takaful Family Hero

Family Takaful plan with high protection payout

Takaful Family Hero is designed for the wellbeing of your family's future. This Zurich takaful family care plan is comparable to a conventional life insurance plan. It can protect you and your loved ones from the burden of debt, so that they can carry on living life the way you aspire them to.

A Hibah Takaful plan to ensure financial security for your loved ones when you are no longer around.

Leave behind fond memories, not debt...

You are now one step closer to a more financially secured future. Before committing to any family takaful plans, it is important for you to find out the ideal coverage for your current liabilities.

Find out now with our Debt Gap Calculator

Takaful Family Hero Product Features and Benefits

Hajj by Proxy, Qurban, Waqaf and Charity

Shariah-Compliant Contribution Gateway

Flexible Contribution channel

![]()

As an added value to your Takaful coverage, you may supplement your plan in association with Amanah Raya Berhad to achieve spiritual objectives.

![]()

With our brand new contribution gateway – PayHalal, rest assured that there are no elements of Riba’ (usury) and Gharar (unknown consequences).

![]()

You can now make your contribution through multiple channels such as cheque, easy pay, bank standing instruction, BSN Giro, internet banking, auto debit/ direct debit or simply walk into any Zurich Takaful branch to make your contributions over the counter.

The Takaful Family Hero plan lets you fulfill your spiritual objectives and pilgrimage (Hajj or Umrah) by offering various services. Check these following takaful value-added services :

- Hajj by Proxy (Badal Haji): Appoint a proxy to ensure that your obligation to perform hajj is achieved even when you are no longer around.

- Qurban Service: Assists to fulfill your religious need of sacrificing an animal and distributing the meat to the designated group of people during Aidiladha.

- Waqaf Service: This service lets you perform charity consistently by distributing your allocated fund to your preferred Waqaf recipient.

- Charity Service: This service caters to non-muslim customers. It helps you in your desire to do charity work by providing a list of charity organizations. You can select one from the list and offer your help to those in need.

High protection payout of up to 400% of Basic Sum Covered (BSC)

If death or Total and Permanent Disability happens, Takaful Family Hero will provide you the following:

| Benefit | Benefit Payable |

| Death or Total and Permanent Disability¹ (TPD) |

Higher of 100% of BSC or Participant Investment Account (PIA) Value |

1 The TPD benefit is only applicable up to age 75 of the Person Covered.

If accidental death occurs, benefit payout will be given according to the table below:

| Benefit | Benefit Payable |

| Public Transportation Accidental Death² |

Death Benefit + 100% of BSC |

| Overseas Accidental Death³ | Death Benefit + 100% of BSC |

| Balik Kampung Accidental Death4 | Death Benefit + 200% of BSC |

| Hajj Accidental Death5 |

Death Benefit + 300% of BSC |

2 In the event of death of the Person Covered within 365 days from the date of accident from commuting in Public Transportation.

3 In the event of death of the Person Covered within 365 days from the date of accident while travelling overseas for not more than 90 consecutive days per trip.

4 In the event of death of the Person Covered within 365 days from the date of accident occurring during Malaysia National Public Holiday and at any of the Toll Expressway in Operation.

5 Note:

i. In the event of death of the Person Covered within 365 days from the date of accident while performing the Hajj ritual which refers to Wukuf in Arafah, Tawaaf in Masjidil Haram and Sa’ie between Safa and Marwah mountains.

ii. In the event that the Person Covered has fulfilled the duty of Hajj where this Hajj Accidental Death Benefit is no longer applicable; or if the Person Covered is a non-muslim, we shall substitute this Hajj Accidental Death Benefit with Overseas Accidental Death Benefit as stated above, with an additional amount of 100% of Basic Sum Covered.

*Note: Only the highest death benefit is payable.

Total and Permanent Disability (TPD) Yearly Recovery Benefit

In the unfortunate event that you suffer a TPD, 5% of Basic Sum Covered is payable for 10 years, by Zurich Takaful as TPD Yearly Recovery Benefit to ease your financial burden.

Family Care Privilege

Secure the lifestyle that you want your loved ones to live, even when you are no longer around. Up to 4 of your legal spouses or children will be entitled to participate in a Zurich family takaful plan with coverage of up to 25% of your Basic Sum Covered, subject to RM300,000 per life, without any underwriting*.

*Terms and conditions apply.

No Medical Check-up Required

You can get covered up to RM1,500,000 without having to go for a medical check-up*.

*Depending on the age and health condition of the person covered

Flexibility to Suit Your Needs

Based on your needs, you may choose your preferred family takaful coverage term of 20 years or up to 80 years old of age and contribution term as follows:

| Contribution Term | Minimum Sum Covered |

| 10 years or 20 years | RM250,000 |

| Throughout Certificate Term |

RM50,000 |

Ziarah Plus Benefit

Protect yourself and your loved ones while you are performing your holy pilgrimage or Umrah. Our takaful family plan pays an additional 10% of Basic Sum Covered or maximum of RM50,000, whichever is lower, if any of the events below occur while you are performing Hajj or Umrah in Saudi Arabia:

- Death due to Heat Stroke, Stampede or Crush Injuries

- Death due to Fire in Public Building

- Death due to Middle East Respiratory Syndrome Coronavirus (MERS-Cov)*

*The MERS-Cov must be first diagnosed while in Saudi Arabia within 21 days returning from Saudi Arabia. If death occurs more than 21 days after leaving Saudi Arabia, this benefit is not payable.

Enhance Your Protection with Riders

You can attach the following Zurich Takaful riders to enhance your protection:

- KritikalCare Essential provides coverage for 50 Critical Illnesses, including 3 most commonly diagnosed Critical Illnesses* such as stroke, heart attack and cancer.

- KritikalCare Waiver is an additional protection. The contribution will be waived in the event you are diagnosed with any one of the 50 Critical Illnesses covered.

*Source: “Critical Planning.” The Star, 2014.

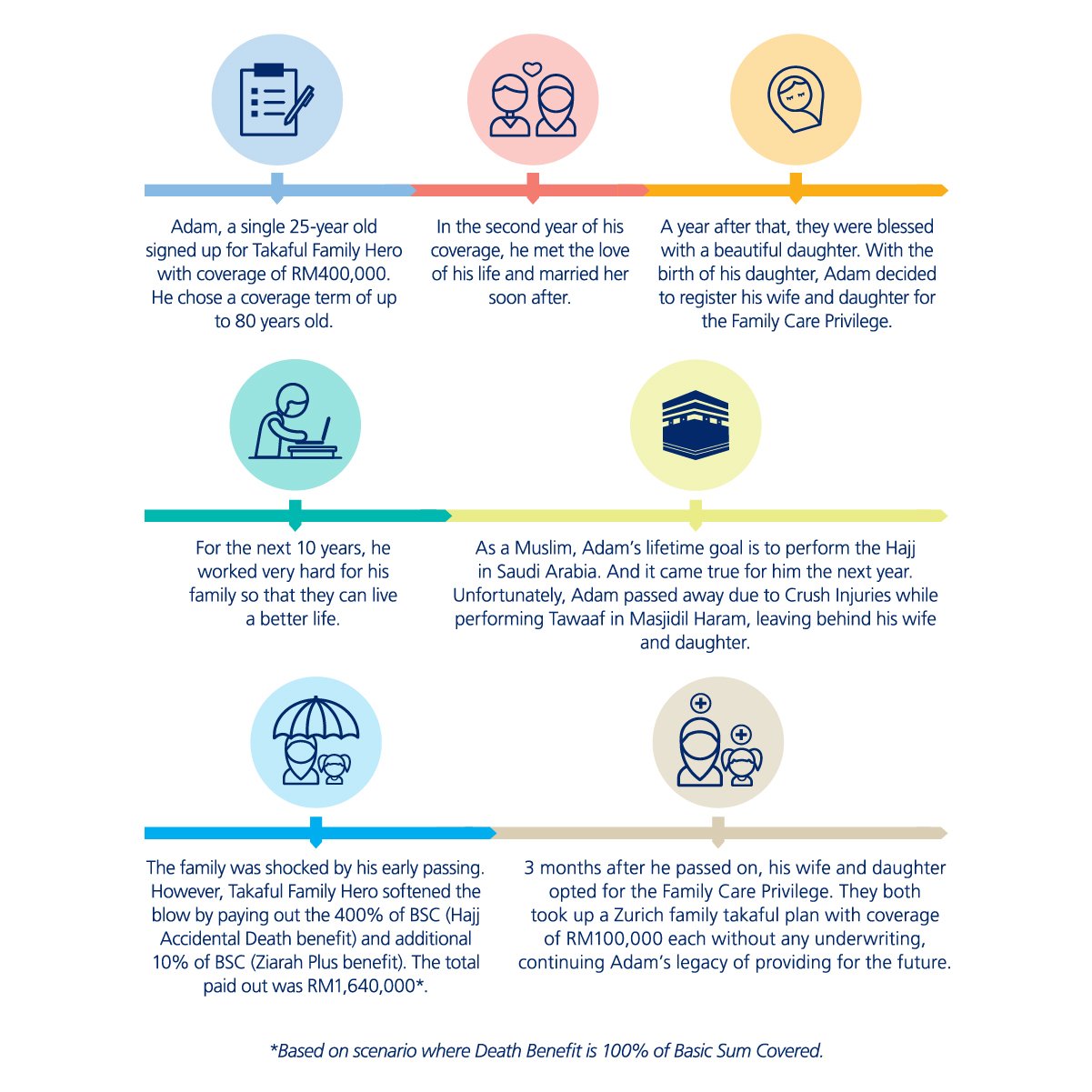

Performing Hajj is an important obligation in the life of a Muslim. This Zurich Takaful family protection plan helps fulfill this religious aspiration. Check below to know how the Takaful Family Hero plan works:

However, the Participant must be at least 16 years old.

What is Takaful Family Hero plan

Takaful Family Hero provides financial protection to you and your family and ensures a safe future that is without any debts. This takaful family plan offers high protection payouts, so if you succumb to an unfortunate life-threatening event, rest assured that your family won’t have to struggle financially to make ends meet.

The contribution required to avail the Takaful Family Hero plan is as low as RM50/month, so you won’t have to shell out a lot of money to create a financially sound future for your loved ones.

How is Family Takaful plan different from conventional life insurance plans?

Unlike conventional life insurance plans, the Takaful Family Hero plan is based on Shariah ideals. It offers high protection payouts too, to ensure your family's and your financial security, in case of unfortunate life events. This affordable Zurich takaful family protection plan, offers added benefits and riders to fulfill your spiritual objectives and other critical needs.

Am I eligible to be covered by this plan?

The minimum entry age of the person covered for this plan is 14 days old and maximum entry age is up to 70 years old, subject to the coverage term and contribution term. However, the Participant must be at least 16 years old.

What is the minimum and maximum Basic Sum Covered for this plan?

The minimum Basic Sum Covered is RM50,000 and maximum Basic Sum Covered is subject to underwriting requirements.

What is the contribution mode available for Takaful Family Hero?

Contribution can be made annually, semi-annually, quarterly or monthly.

How does Family Care Privilege work?

In the event of death of the Person Covered, up to 4 of legal spouses or children are entitled to participate in our Zurich family takaful plan with up to 25% of Basic Sum Covered, subject to a cap of RM300,000 per life, without underwriting.

Is the contribution made for this plan eligible for income tax relief?

Yes. The contribution(s) made is entitled to income tax relief in addition to your other family takaful or life insurance plans, subject to the final decision of the Inland Revenue Board of Malaysia (IRB).

What are the exclusions for Takaful Family Hero?

Takaful Family Hero does not cover the events listed below. Please note that the list is not exhaustive and reference should be made to the comprehensive list in our Product Disclosure Sheet and Takaful Certificate.

Death Benefit

This certificate shall not cover any death from suicide within one (1) year from this Certificate Commencement Date or Reinstatement Date, whichever is later, whether the Person Covered is sane or insane. Our liability shall be limited to the PIA value on the date of death. Total and Permanent Disability Benefit This Certificate shall not cover any disability caused directly or indirectly, wholly or partly, by and of the following occurrences:

a. Any self-inflicted injuries while sane or insane; or

b. Travel or flight in or on any type of aircraft except on a regular scheduled passenger flight of a commercial aircraft; or

c. Any activities of a military nature whilst being engaged in military service in time of declared or undeclared war whilst under orders for warlike operations or restoration of public order.

For all the Accidental Death Benefits

This plan does not cover any accidental death or injuries arising directly or indirectly, wholly or partly, by any one (1) of the following occurrences:

a. Self-destruction or any attempt thereat or self-inflicted injury while sane or insane, intoxication by alcohol or drugs/narcotics of any kind (other than those taken in accordance with treatment prescribed and directed by the Registered Medical Practitioner, but not for the treatment of drug or alcohol addiction);

b. War, declared or undeclared, revolution or any warlike operations, and any act of terrorism. For the purpose of this Supplementary Contract an act of terrorism means an act, including but not limited to the use of force or violence and/or the threat thereof, of any person or group(s) of persons, whether acting alone or on behalf of or in connection with any organisation(s) or government(s), committed for political, religious, ideological, or ethnic purposes or reasons including the intention to influence any government and/or to put the public, or any section of the public, in fear;

c. Armed forces or police service in time of declared or undeclared war while under orders for warlike operations or restoration of public order (except those personnel who are administration staff);

d. Racing on horses or wheels;

e. Participation in professional sports (including caving, potholing and bungee jumping).

Middle East Respiratory Syndrome Coronavirus (MERS-Cov) resulting in death

If the death occurs due to MERS before the Person Covered enters the international border when travelling to Saudi Arabia or after twenty-one (21) days the person leaves Saudi Arabia.

The benefits payable are protected by PIDM up to limits. Please refer to PIDM TIPS brochure or contact Zurich Takaful Malaysia Berhad or PIDM.

Zurich Takaful operates under the principle of Wakalah, whereby the Takaful Operator acts as an agent to the Participant for managing the operations of the Takaful business. A Wakalah Fee will be charged up-front from the contributions made. Tabarru’ (donation) will be deducted to the Participant Risk Investment Account (PRIA), where it will be used for mutual aid and assistance, based on the concept of Takaful. The benefits are paid from the PRIA only upon a covered loss, and not upon maturity or surrender of the certificate. Surplus Sharing (if any) at the end of each financial year will be shared between the Participant, and Zurich Takaful at a 50:50 ratio. The investment profit earned on the Participant Investment Account (PIA) is derived from the return on underlying assets and Zurich Takaful charges a Wakalah Bi al-Istithmar Fee (Investment Agency Fee) for managing these assets. The investment risk in PIA is fully borne by the Participant. 100% of investment profit earned, net of tax, less the aforementioned Wakalah Bi al-Istithmar Fee, will remain in the PIA for the benefit of the Participant. There will be no further sharing of the investment profit arising in the PIA with Shareholders.