Save smarter, grow your funds faster and stay protected - Takaful ProAspire

Your dreams, our aspiration

Boost your savings and accessibility with Saver Account

Supercharge your savings with a simple top-up, choose between regular or irregular top-up and experience the freedom of accessing funds from your Participant Investment Account (PIA) or Saver Account whenever you need. The funds you invest into Saver Account will not be subject to Tabarru’ charges or withdrawal fee, ensuring your savings remain secure.

Celebrate your savings milestone with Loyalty Reward

Upon certificate maturity, receive a lump sum payment up to 100% of your Basic Sum Covered as Loyalty Reward. The Participant Investment Account (PIA) Value (if any) and Saver Account Value (if applicable) will be payable, allowing you to accomplish your goals with assurance and peace of mind.

| Coverage Term | Loyalty Reward |

|---|---|

| 15 or 21 Years | 50% of Basic Sum Covered |

| 30 Years | 100% of Basic Sum Covered |

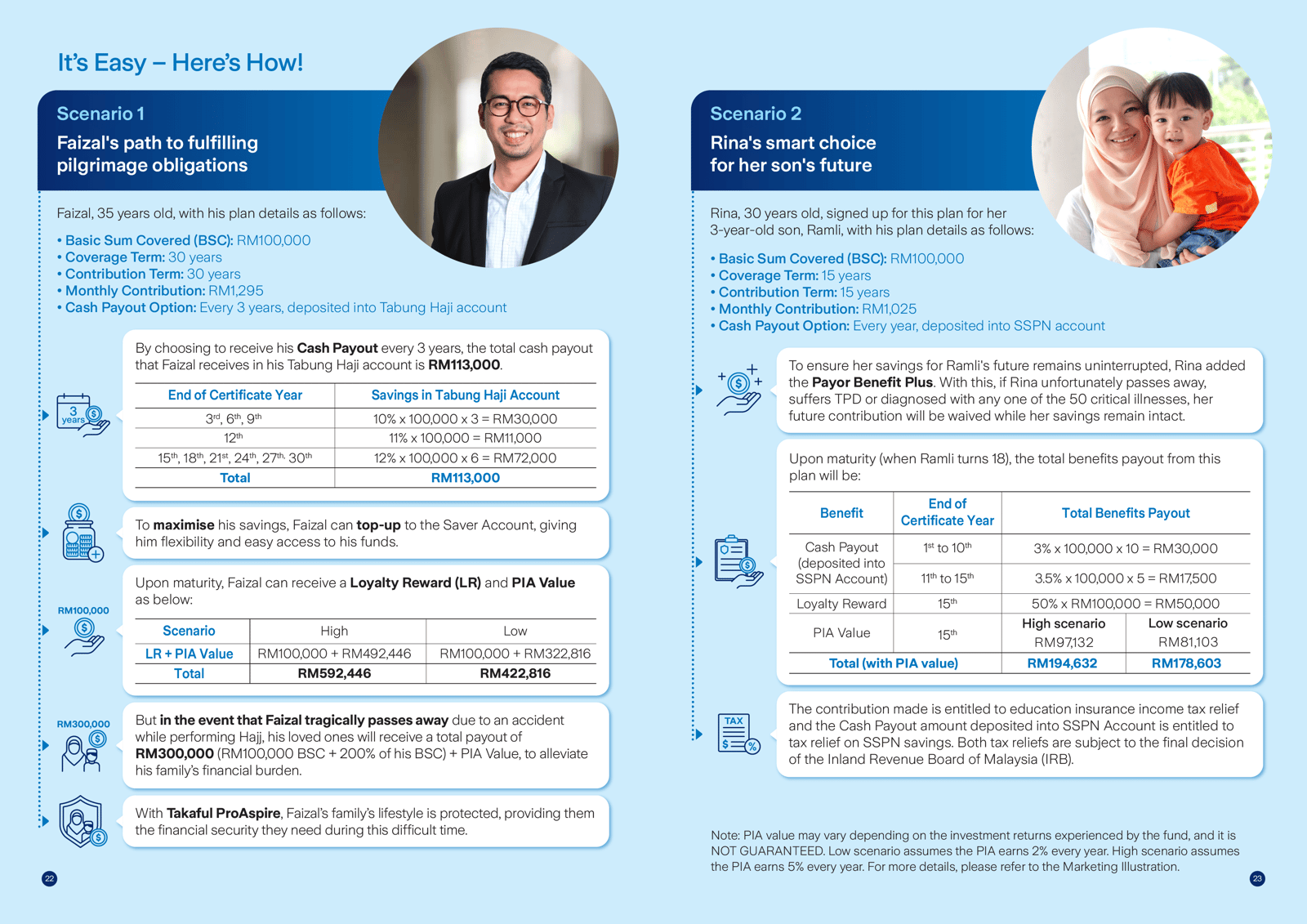

Watch your savings grow with Cash Payout

Choose to receive your continuous cash payout either annually or every 3 years.

| Annually | Up to 3.5% of Basic Sum Covered |

| Every 3 Years | Up to 12% of Basic Sum Covered |

Achieve your goals with purpose-driven savings, where you can:

• Support your religious obligation: Deposit the cash payout into an existing Tabung Haji account;

• Contribute towards educational goals: Transfer the cash payout straight into an existing National Education Savings Scheme (SSPN) account;

• Personal goals or dreams: Receive the cash payout directly to your bank account; or

• Accumulate for a stable financial future: Reinvest the cash payout into your Saver Account.

Remain protected with up to 300% of Basic Sum Covered

In case something happens to you, this plan will provide the following:

| Death / Total and Permanent Disability (TPD) / Golden Age Disability (GAD) | 100% of Basic Sum Covered (BSC) + Participant Investment Account (PIA) Value (if any) |

| Accidental Death | Death Benefit + 100% of BSC |

| Accidental Death while Performing Hajj or Umrah | Death Benefit + 200% of BSC |

Get continuous coverage as you age

Enjoy peace of mind with Total and Permanent Disability (TPD) benefit up to age 75, along with continuous coverage through Golden Age Disability (GAD).

Flexible choices for worry-free protection

With a flexible selection of coverage terms of 15, 21 or 30 years, you have the option to contribute for either 5 years or throughout the chosen coverage term.

Elevate your coverage

Enhance your protection in the event of an unforeseen circumstance with our optional riders.

The benefits payable are protected by PIDM up to limits. Please refer to PIDM TIPS brochure or contact Zurich Takaful Malaysia Berhad or PIDM.