Zurich EduMax

Maximise your child’s potential with the right start

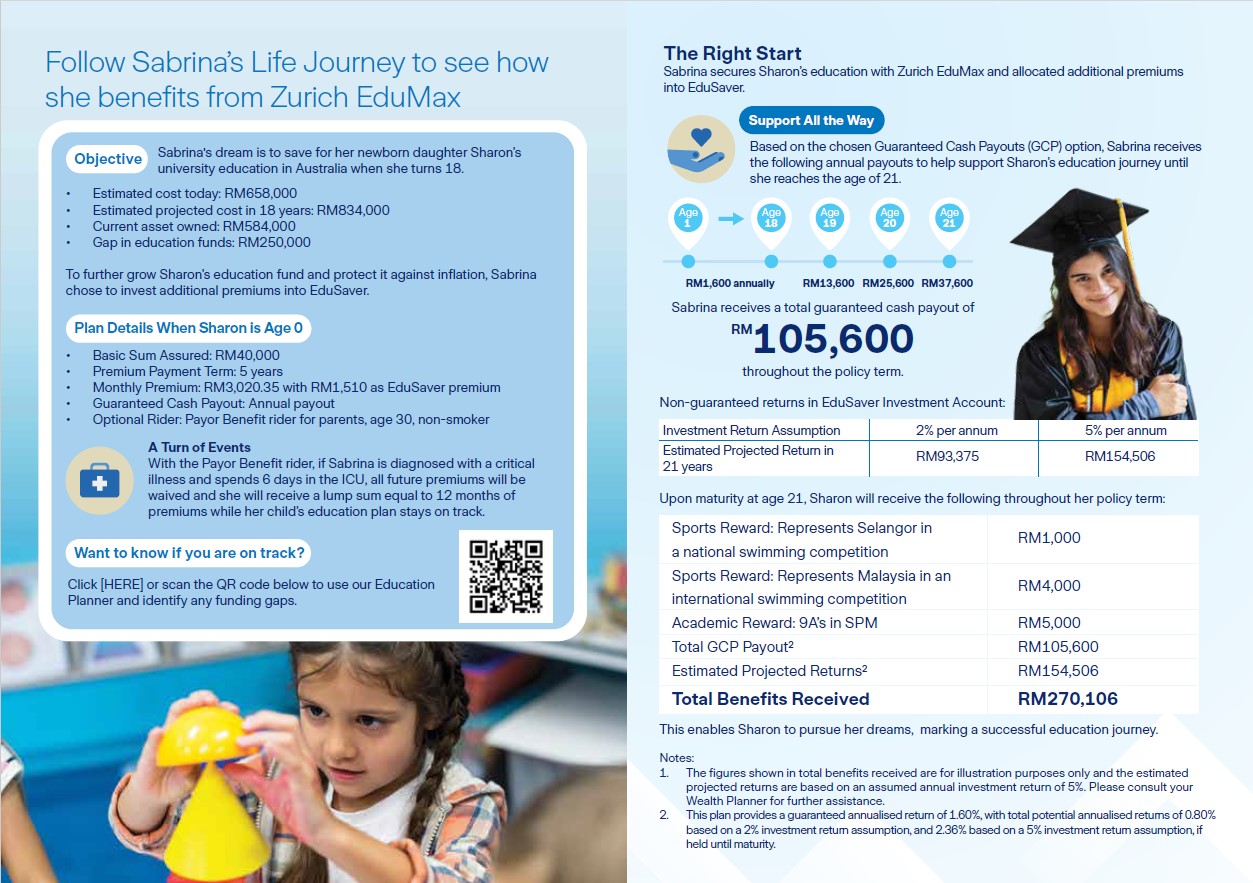

Zurich EduMax is a forward-thinking savings solution that grows your child’s education fund, offers guaranteed returns and milestone rewards, provides flexible investment options, and ensures protection with optional Payor Benefit rider.

Plan your child’s education with ease using our Education Planner! Get a quick estimate of costs, explore funding options, and make confident decisions for their future. Click to access our Education Planner and identify any funding gaps.

![]() Rewarding Every Achievement with Milestone Celebration Rewards

Rewarding Every Achievement with Milestone Celebration Rewards

Beyond growing your savings, this plan celebrates your child’s excellence with special rewards of up to RM10,000 starting from the 3rd policy year.

Education Reward: One-time reward for your child's academic excellence.

| Examination | Requirement Category 1: RM1,000 | Requirement Category 2: RM5,000 |

|---|---|---|

| Sijil Pelajaran Malaysia (SPM) | Minimum of 5As | Minimum of 9As |

| International General Certificate of Secondary Education (IGCSE) | ||

| Unified Certified Exam – Senior Middle Level (UEC-SML) | ||

| Sijil Vokasional Malaysia (SVM) | Overall CGPA of 3.50 or higher | Overall CGPA of 3.80 or higher |

Sports Reward: Celebrate your child’s achievements in each sports category with well-deserved recognition.

| Requirement | Category | Benefit Amount |

|---|---|---|

| A state player representing the state in Malaysia | National | RM 1,000 |

| A national player representing Malaysia | International | RM 4,000 |

![]() Rewarding Every Achievement with Milestone Celebration Rewards

Rewarding Every Achievement with Milestone Celebration Rewards

Enjoy Guaranteed Cash Payouts (GCP) in the way that best fits your needs.

Option 1 – Annual GCP payouts

Receive steady yearly payouts to help cover tuition fees, books and other educational needs as they come.

| Age at the end of policy year / Additional Lump Sum GCP | Percentage of chosen Basic Sum Assured |

|---|---|

| Every year until age 21 | 4% |

| Age 19 | 30% |

| Age 20 | 60% |

| Age 21 | 90% |

Option 2 – Lump sum GCP payouts starting from age 19 to 21

Opt for a larger payout when it matters most, giving you flexibility to fund major milestones such as university entry.

| Age at the end of policy year | Percentage of chosen Basic Sum Assured |

|---|---|

| Age 19 | 60% |

| Age 20 | 80% |

| Age 21 | 120% |

Enjoy the flexibility! Here is how you can receive your GCP*:

- Deposit the GCP in your bank account, less any indebtedness; or

- Allow your GCP to accumulate with an interest rate determined by Zurich; or

- Reinvest your GCP in EduSaver Investment Account, if applicable.

*The interest rate for accumulating GCP is not guaranteed and may vary from time to time. To view the annualised return, please refer to Product Disclosure Sheet and sales illustration.

![]() Two Payors, One Secure Path with Payor Benefit Rider

Two Payors, One Secure Path with Payor Benefit Rider

Secure your child’s education fund with this optional rider to enjoy these valuable benefits:

Premium Waiver – Future premiums are waived if the payor passes away, suffers Total and Permanent Disability (TPD), or is diagnosed with a covered Critical Illness.

ICU Support Benefit – Receive a lump sum equal to 12 months’ premiums to help cover future premiums if the payor is admitted to an Intensive Care Unit (ICU) for more than 5 consecutive days.

Dual Payor Protection with Extra Savings – Give both parents equal protection to keep your child’s education fund secure, no matter what happens. Plus, enjoy 10% savings on the second payor’s rider premium, making it easier and more rewarding to plan together.

![]() A Savings Assistant Built into Your Policy

A Savings Assistant Built into Your Policy

With the optional EduSaver Investment Account, you can grow your money smarter by:

Investing additional premiums in a diverse range of local and foreign investment-linked funds, such as Zurich US Edge Fund, Zurich Global Green Fund, and more, to maximise your growth potential; or

Boosting your returns by reinvesting your Guaranteed Cash Payouts into this dedicated investment account.

![]() Your Safety Net Against Unfortunate Events

Your Safety Net Against Unfortunate Events

In the event of life’s unexpected turns, any of the following benefits will be payable:

| Requirement | Policy Year | Benefits Payable |

|---|---|---|

| Death Benefit (not due to an Accident) | First 2 years | The sum of: a. Total basic premium paid, less total GCP received; b. Accumulated GCP (if any) less any indebtedness. |

| 3rd year onwards | The sum of: a. The highest of: - Basic Sum Assured; or - Total basic annual premium paid, less total GCP received; or - Guaranteed cash value b. Accumulated GCP (if any) less any indebtedness. | |

| Death Benefit (due to an Accident) | 1st year onwards |

Note:

1. All benefits are subject to terms and conditions.

2. Please refer to the Product Disclosure Sheet and policy documents for further details.

This plan is open to anyone between 14 days old and 10 years old (attained age). However, the policyholder must be at least 16 years old

The benefits payable are protected by PIDM up to limits and the protection on benefits from the unit portion is subject to limitations. Please refer to PIDM TIPS brochure or contact Zurich Life Insurance Malaysia Berhad or PIDM.